All Categories

Featured

Table of Contents

Indexed universal life plans provide a minimal guaranteed interest price, additionally understood as a passion attributing floor, which reduces market losses. Say your cash value loses 8%.

A IUL is a permanent life insurance coverage policy that borrows from the homes of an universal life insurance coverage plan. Unlike global life, your cash value grows based on the performance of market indexes such as the S&P 500 or Nasdaq.

What makes IUL various from various other policies is that a part of the superior repayment goes right into annual renewable-term life insurance policy. Term life insurance, additionally understood as pure life insurance coverage, assurances fatality benefit repayment.

An IUL policy could be the appropriate choice for a customer if they are trying to find a long-lasting insurance item that builds wide range over the life insurance term. This is since it provides potential for growth and also preserves one of the most value in an unsteady market. For those that have considerable possessions or riches in up front investments, IUL insurance policy will be a great wide range management tool, particularly if someone wants a tax-free retired life.

Who has the best customer service for Long-term Iul Benefits?

In comparison to various other policies like variable global life insurance policy, it is much less risky. When it comes to taking care of recipients and handling wealth, below are some of the top factors that someone may choose to choose an IUL insurance coverage policy: The cash value that can accrue due to the interest paid does not count towards revenues.

This means a client can use their insurance coverage payment as opposed to dipping right into their social safety and security money before they prepare to do so. Each policy needs to be tailored to the client's individual requirements, especially if they are managing substantial assets. The insurance policy holder and the representative can select the amount of danger they think about to be proper for their demands.

IUL is a general quickly adjustable strategy. Due to the passion rates of global life insurance plans, the rate of return that a client can possibly obtain is higher than other insurance protection. This is due to the fact that the owner and the agent can leverage call options to raise feasible returns.

Iul Vs Term Life

Policyholders may be drawn in to an IUL policy because they do not pay funding gains on the additional cash money worth of the insurance coverage. This can be contrasted to various other policies that require tax obligations be paid on any kind of cash that is secured. This implies there's a cash property that can be taken out any time, and the life insurance coverage policyholder would certainly not need to bother with paying tax obligations on the withdrawal.

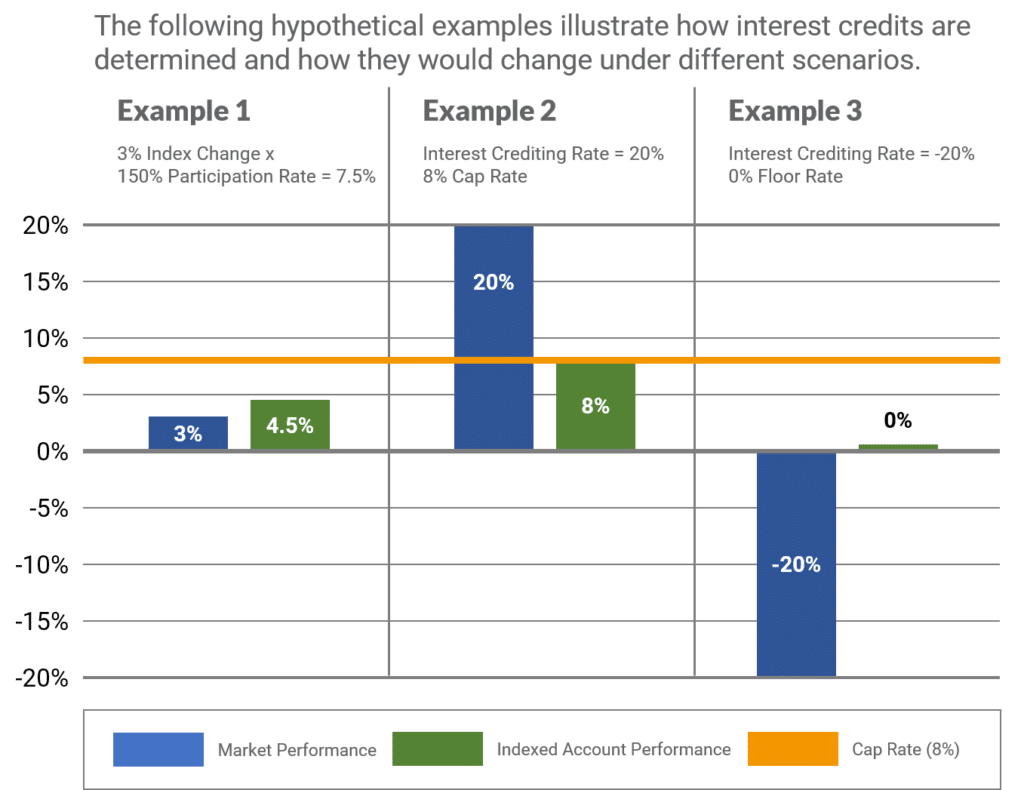

While there are several benefits for an insurance holder to pick this type of life insurance policy, it's not for every person. It is essential to let the customer recognize both sides of the coin. Below are a few of one of the most crucial points to encourage a customer to take into account before going with this choice: There are caps on the returns an insurance policy holder can obtain.

The best alternative depends on the customer's threat resistance - Indexed Universal Life insurance. While the costs connected with an IUL insurance plan deserve it for some consumers, it is necessary to be ahead of time with them concerning the expenses. There are premium cost charges and other administrative charges that can begin to build up

No guaranteed passion rateSome various other insurance plan supply a rate of interest that is assured. This is not the instance for IUL insurance policy. This is fine for some, but for others, the unidentified fluctuations can leave them feeling exposed and insecure. To get more information about taking care of indexed global life insurance policy and recommending it for certain clients, reach out to Lewis & Ellis today.

What is the difference between Indexed Universal Life Plans and other options?

It's attributing rate is based on the performance of a stock index with a cap price (i.e. 10%), a floor (i.e.

8 Permanent life irreversible consists insurance coverage is composed types: whole life entire universal life. Cash worth expands in a taking part whole life plan with returns, which are stated annually by the business's board of supervisors and are not assured. Cash value expands in an universal life policy via attributed rate of interest and decreased insurance coverage costs.

What types of Iul Interest Crediting are available?

Despite exactly how well you prepare for the future, there are events in life, both anticipated and unforeseen, that can impact the economic well-being of you and your loved ones. That's a reason forever insurance coverage. Survivor benefit is normally income-tax-free to beneficiaries. The survivor benefit that's generally income-tax-free to your recipients can assist ensure your household will have the ability to preserve their criterion of living, assist them maintain their home, or supplement lost income.

Things like prospective tax increases, inflation, economic emergency situations, and preparing for occasions like university, retired life, or also weddings. Some types of life insurance policy can aid with these and various other problems as well, such as indexed global life insurance, or merely IUL. With IUL, your plan can be an economic source, due to the fact that it has the possible to develop value with time.

An index might influence your passion credited, you can not spend or directly take part in an index. Here, your policy tracks, however is not really spent in, an exterior market index like the S&P 500 Index.

Charges and expenditures might reduce policy worths. This rate of interest is secured in. If the market goes down, you will not shed any kind of rate of interest due to the decline. You can additionally choose to get fixed interest, one collection foreseeable rates of interest month after month, regardless of the marketplace. Due to the fact that no single appropriation will certainly be most efficient in all market settings, your financial expert can assist you establish which combination may fit your financial goals.

What does a basic Indexed Universal Life plan include?

That leaves more in your policy to possibly keep expanding over time. Down the road, you can access any kind of offered cash money worth through plan lendings or withdrawals.

Latest Posts

Difference Between Whole Life Vs Universal Life

How Much Does Universal Life Insurance Cost

Level Premium Universal Life Insurance